How to afford an university?

As a 18-year-old in the United States, paying for university can be a major financial challenge. However, there are several ways to make it more affordable. Here are some strategies to consider:

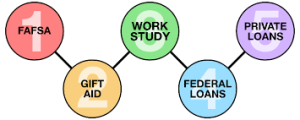

- Fill out the Free Application for Federal Student Aid (FAFSA): The first step in paying for university is to fill out the FAFSA. This form will help you determine your eligibility for federal grants, loans, and work-study programs. You may also be eligible for state-specific financial aid or grants from your university.

- Look for scholarships: There are many organizations that offer scholarships to students based on merit, financial need, or other factors. It’s worth doing some research and applying for as many scholarships as possible. You can find scholarship opportunities through your university, online databases, and community organizations.

- Work part-time: If you’re able to work part-time while going to school, this can be a great way to pay for some of your expenses. Many universities have on-campus jobs available, which can be convenient and flexible.

- Take out loans: If you need to borrow money to pay for university, there are several types of loans available. Federal student loans are typically the most affordable option, as they have fixed interest rates and offer flexible repayment plans. Private loans, on the other hand, may have higher interest rates and may require a co-signer. It’s important to carefully consider the terms and conditions of any loan before borrowing.

- Enroll in a community college: Attending a community college for the first two years of your degree can be a cost-effective way to get a higher education. Community colleges often have lower tuition costs than four-year universities, and credits earned at a community college can often be transferred to a four-year institution.

- Consider an online degree: Online degree programs can be a more affordable option, as they often have lower tuition costs and may not require you to pay for housing or transportation. Just be sure to do your research and make sure that the online program is accredited and reputable.

- Choose a cheaper school: If you’re open to attending a school that may not be your first choice, it could save you money in the long run. Consider factors like in-state versus out-of-state tuition, public versus private institutions, and the overall cost of living in the area.

- Get creative: There are many other ways to pay for university, such as crowdfunding, taking out a personal loan, or participating in a work-study program. It may also be possible to negotiate a lower tuition rate with your school, especially if you have a unique financial situation.

Paying for university can be a daunting task, but with some careful planning and a little bit of creativity, it is possible to afford a higher education in the United States. By considering all of your options and making a budget, you can find a solution that works for you and your financial situation.

Paul Green

As a business administrator specializing in student loan management, I have a deep understanding of the complex financial and regulatory issues facing borrowers and lenders. I am skilled in developing and implementing effective loan programs, and have a strong track record of helping students and their families navigate the loan process and achieve their educational and financial goals.

Copyright © 2022 Plus One Education